Translate »

To assist in the formulation of various Village policies or actions concerning community development, various plans and reports are prepared. Below are key plans and reports that assist the Village in establishing policies or taking actions.

The Village uses several sources of revenue to fund government operations. The largest source of revenue for the Village is Sales Tax, which accounts for 23% of the total revenue received. The revenue the Village receives is allocated in the following manner:

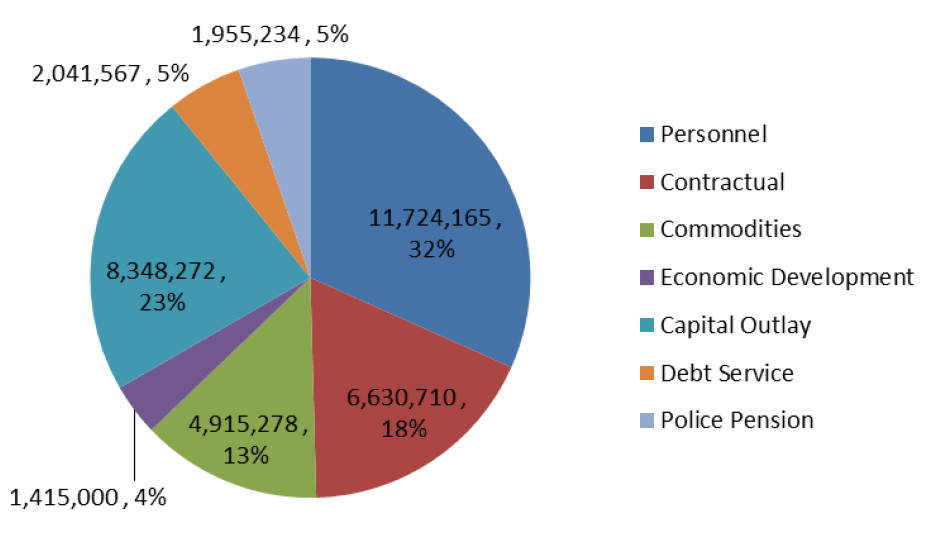

The Village allocates expenses in the following manner:

An additional 1% tax is collected on the purchase of prepared food and beverages, resulting in a total tax of 11% on these purchases.

The Village’s natural gas and electricity utility tax rates are 5.15%. For more information regarding utility tax rebates for elderly and low income residents.

The simplified municipal telecommunications tax rate is 13%, 6% of which is allocated to the Village and 7% is allocated to the State of Illinois.